Client Testimonials

Real Cases

Fred (age 55) showed up at June’s residence (age 80) with a bouquet of roses claiming to be her long, lost son. (Disputed evidence later showed he staked out in her back shed for some time before coming to her door). He had met her as a child only. June was vulnerable and welcomed him a kind visitor.

Fred took her to fancy dinners and basically wined and dined her for months. Over the months he eventually became the beneficiary of her payable-on-death accounts and other assets. She eventually changed her will giving him the bulk of her Texas estate including all of her accounts and home. Fred then moved June from Texas to his Washington home where June “adopted” Fred legally.

I challenged the will based upon undue influence. Fred lost every motion he pursued trying to weaken the case. The adoption made the case more difficult because it was a court order signed by a judge, but nevertheless, Fred ended up losing most of what he had taken from June and had to pay over $300,000.

A caregiver, Ms. B, took her elderly, dependent and confused client to an Edmond’s attorney for a new will. Despite the lack of understanding by the client, the attorney drafted a new will giving the caregiver the bulk of his $500,000 estate. I filed a will contests and deposed the attorney who was completely negligent in his diligence requirement. After the case was over that attorney was disbarred.

Aunt Pearl died without a will. She had 45 lineal descendants; 2 in Washington, the rest in other parts of the county. Her nephew John was quoted some large fees from other attorneys for the probate because of the complexity – bond issues, no will and other potential problems. I gave him a reduced flat fee which we stuck to regardless of the complications.

We worked quickly, within John’s time restrictions. By preliminary preparation of declarations and research, I was able to convince the judge to waive bond and grant nonintervention powers to John even though Pearl had no will. Many of the 45 heirs received much more than they had ever expected because we also pursued earnest money on a real estate contract where the buyer backed out.

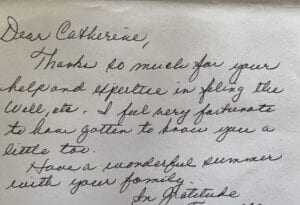

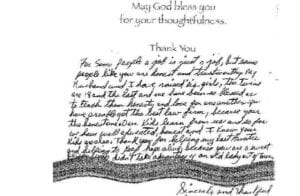

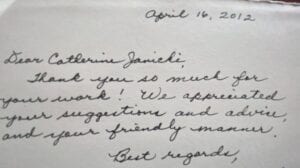

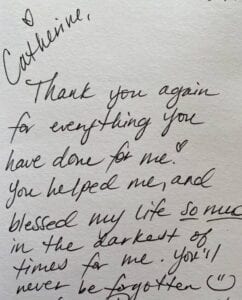

The probate was wrapped up fairly quickly with checks to everyone. I received the nicest “thank you cards” and I think often of that special extended family united across the states by aunt Pearl’s death. Some of them barely knew her, but they came to know each other in a positive way through her.

I’ve challenged Executors and Trustees many times over the years for excessive billing, inaccurate reports, conflicts of interests and self-dealing. Recently an attorney charged the estate over $36,000 for a very simple probate. The attorney also sold the estate car, worth $3,500 to his own son for $1,000 after spending over $4,000 on repairs and fees to the car. I petitioned the court for his removal and disgorgement of fees. His nonintervention powers were suspended and he was restricted from accessing any estate funds or taking any estate action. He is now facing ethical complaints.

We recently discovered a tax lien turned into a loss of ownership for a family who used the property as their own for years even after the tax foreclosure. We searched county records to trace the course of events and eventually cleared up the various defects. In another estate, two probates were never completed properly over 20 years ago. We researched the defects, opened probates where necessary, sent notices to interested heirs and through agreements, court orders and waivers, transferred the titles to the proper owners.

We work to effectively discover actual ownership, correct problems, abolish liens and claims and obtain title clearance. By drafting title corrections and affidavits, sometimes probate and litigation can be avoided thus saving thousands of dollars in fees.

Through parcel searches or at sale, property title is sometimes found to be defective or encumbered. Maybe the ownership did not change property when someone in the line of title died, maybe unknown liens are accumulating interest and penalties, maybe title was suppose to be owned by both spouses with right of survivorship and is not, or searches and recordings will show that the ownership didn’t transfer properly at the death of one spouse.

Many times an agent through a Power of Attorney needs to be made aware of his or her fiduciary obligations in making health and financial decisions for an incapacitate person. I’ve used the statutes many times over the years to compel compliance with the agent’s duties and to help agents (i.e. attorney-in-fact) when they are trying to access accounts, pay bills or make decisions.